Are you feeling a bit uncertain about what’s actually taking place with mortgage rates? That is likely to be since you’ve heard somebody say they’re coming down. However you then learn some other place that they’re up once more. And which will go away you scratching your head and questioning what’s true.

The only reply is: that what you learn or hear will differ primarily based on the timeframe they’re taking a look at. Right here’s some info that may assist clear up the confusion.

Mortgage Charges Are Risky by Nature

Mortgage rates don’t transfer in a straight line. There are too many factors at play for that to occur. As an alternative, charges bounce round as a result of they’re impacted by issues like financial circumstances, choices from the Federal Reserve, and a lot extra. Which means they is likely to be up in the future and down the subsequent relying on what’s occurring within the financial system and the world as a complete.

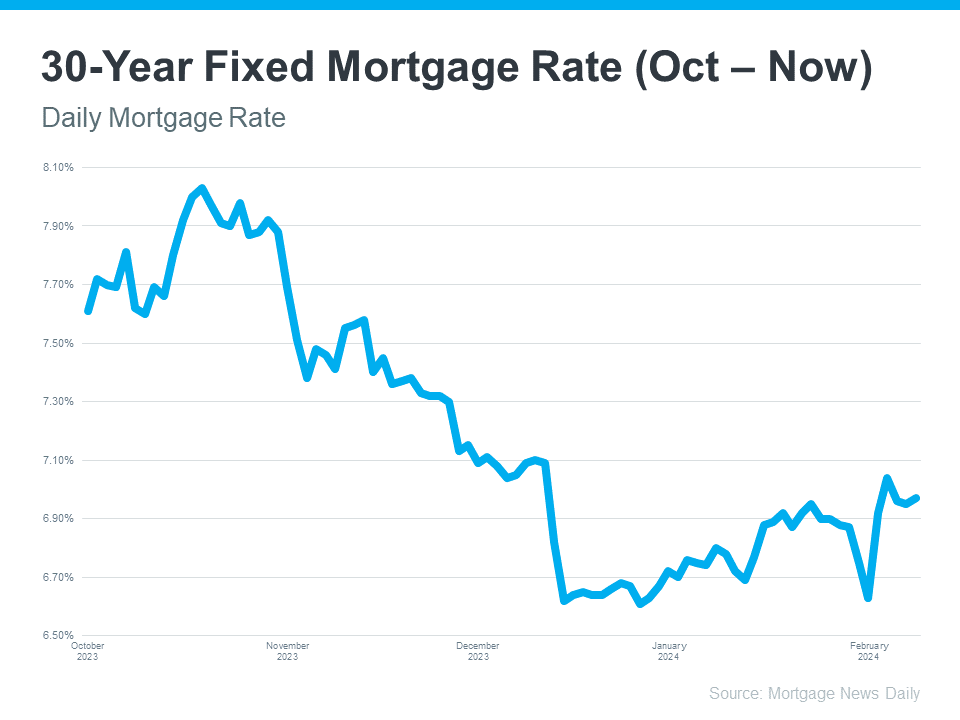

Check out the graph under. It makes use of data from Mortgage Information Each day to indicate the ebbs and flows within the 30-year mounted mortgage price since final October:

If you happen to take a look at the graph, you’ll see a variety of peaks and valleys – some larger than others. And whenever you use knowledge like this to elucidate what’s taking place, the story might be totally different primarily based on which two factors within the graph you’re evaluating.

For instance, in the event you’re solely wanting initially of this month via now, chances are you’ll assume mortgage charges are on the way in which again up. However, in the event you take a look at the newest knowledge level and evaluate it to the height in October, charges have trended down. So, what’s the precise approach to have a look at it?

The Massive Image

Mortgage charges are at all times going to bounce round. It’s simply how they work. So, you shouldn’t focus an excessive amount of on the small, day by day modifications. As an alternative, to actually perceive the general development, zoom out and take a look at the large image.

Whenever you take a look at the best level (October) in comparison with the place charges are actually, you possibly can see they’ve come down in comparison with final 12 months. And in the event you’re trying to purchase a house, that is massive information. Don’t let the little blips distract you. The consultants agree, general, that the bigger downward development might continue this year.

Backside Line

Let’s join if in case you have any questions on what you’re studying or listening to in regards to the housing market.