What Mortgage Price Do You Want To Transfer?

In case you’ve been fascinated about buying a home, mortgage charges are most likely prime of thoughts for you. They could even be why you’ve put your plans on maintain for now. When rates climbed near 8% final 12 months, some consumers discovered the numbers simply didn’t make sense for his or her budget anymore. Which may be the case for you too.

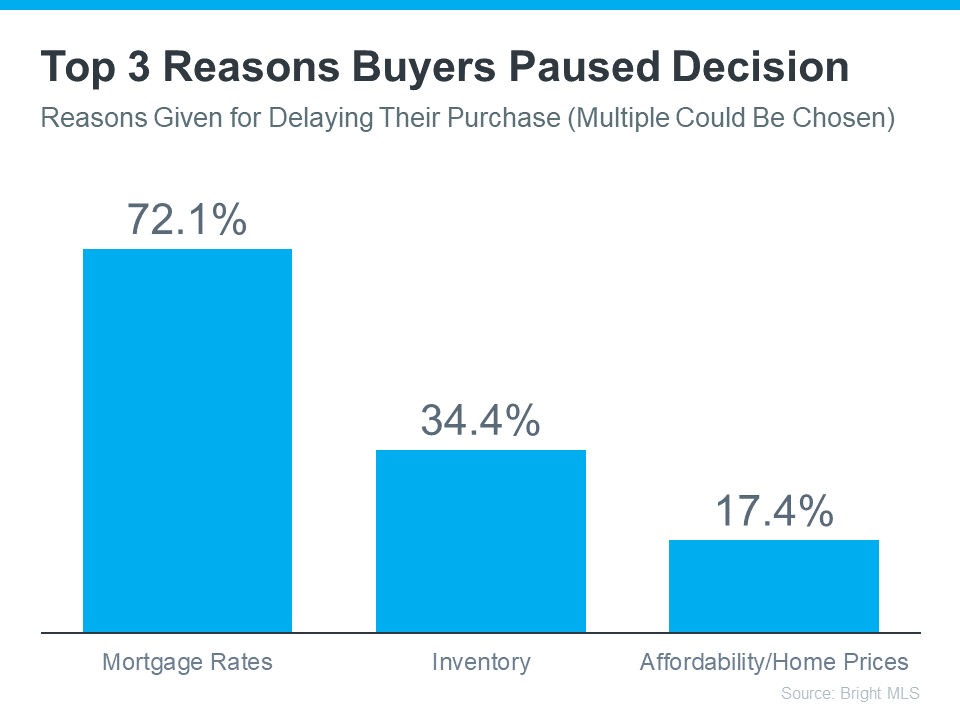

Data from Vivid MLS reveals the highest motive consumers delayed their plans to maneuver is because of excessive mortgage charges (see graph under):

David Childers, CEO at Preserving Present Issues, speaks to this statistic within the current How’s The Market podcast:

“Three quarters of consumers stated ‘we’re out’ on account of mortgage charges. Right here’s what I do know going ahead. That can change in 2024.”

That’s as a result of mortgage rates have come down off their peak final October. And whereas there’s nonetheless day-to-day volatility in charges, the longer-term projections present charges ought to proceed to drop this 12 months, so long as inflation will get beneath management. Specialists even say we may see charges below 6% by the top of 2024. And that threshold can be a gamechanger for lots of consumers. As a current article from Realtor.com says:

“Shopping for a house continues to be desired and wanted, however many individuals are in search of mortgage charges to return down with a view to obtain it. 4 out of 10 People trying to purchase a house within the subsequent 12 months would contemplate it potential if charges drop under 6%.”

Whereas mortgage charges are practically unattainable to forecast, the optimism from the consultants ought to offer you perception into what’s forward. In case your plans have been delayed, there’s gentle on the finish of the tunnel once more. Which means it could be time to begin fascinated about your transfer. The most effective query you possibly can ask your self proper now, is that this:

What quantity do I need to see charges hit earlier than I’m prepared to maneuver?

The precise percentage the place you’re feeling comfy kicking off your search once more is private. Possibly it’s 6.5%. Possibly it’s 6.25%. Or possibly it’s as soon as they drop under 6%.

After getting that quantity in thoughts, right here’s what you do. Join with a neighborhood real estate professional. They’ll provide help to keep knowledgeable on what’s occurring. And when charges hit your goal, they’ll be the primary to let you already know.

Backside Line

In case you’ve put your plans to maneuver on maintain due to the place mortgage charges are, take into consideration the quantity you need to see charges hit that will make you able to re-enter the market.

After getting that quantity in thoughts, let’s join so you have got somebody in your aspect to let you already know once we get there.