What Decrease Mortgage Charges Imply for Your Buying Energy

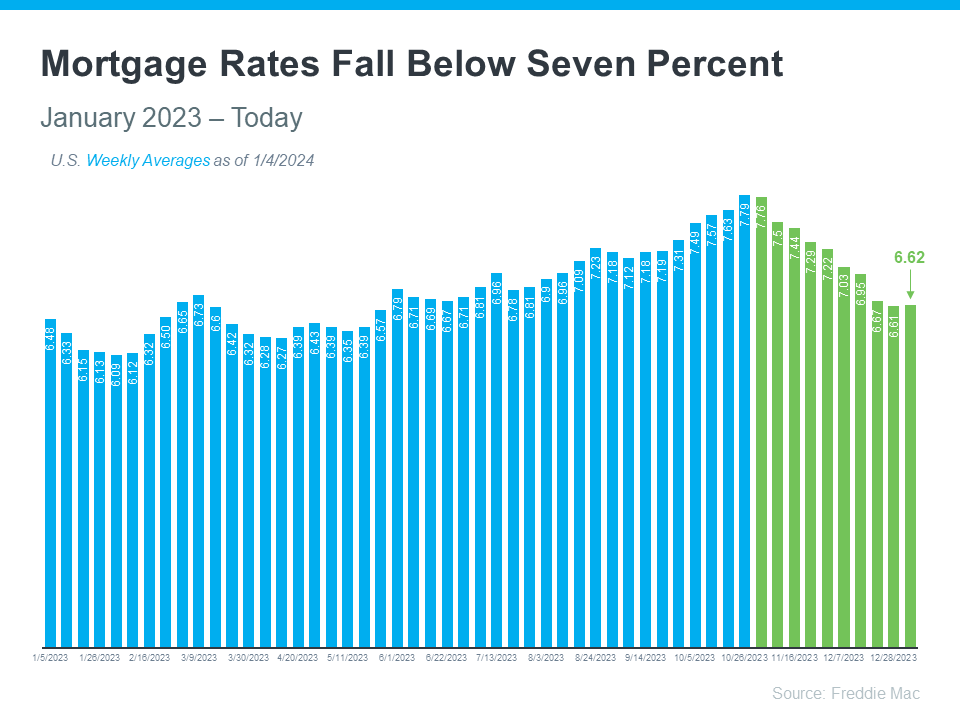

If you wish to buy a home, it is vital to know the way mortgage rates impression what you may afford and the way a lot you’ll pay every month. Luckily, charges for 30-year fastened mortgages have come down considerably for the reason that finish of October and are at the moment underneath 7%, in keeping with Freddie Mac (see graph under):

This latest pattern is nice information for buyers. As a latest article from Bankrate says:

“The speed cool-off considerably eases the housing affordability squeeze.”

And according to Edward Seiler, AVP of Housing Economics and Government Director of the Analysis Institute for Housing America on the Mortgage Bankers Affiliation (MBA):

“MBA expects that affordability circumstances will proceed to enhance as mortgage charges decline . . .”

Right here’s a bit extra context on how this might assist along with your plans to buy a home.

How Mortgage Charges Have an effect on Your Seek for a House

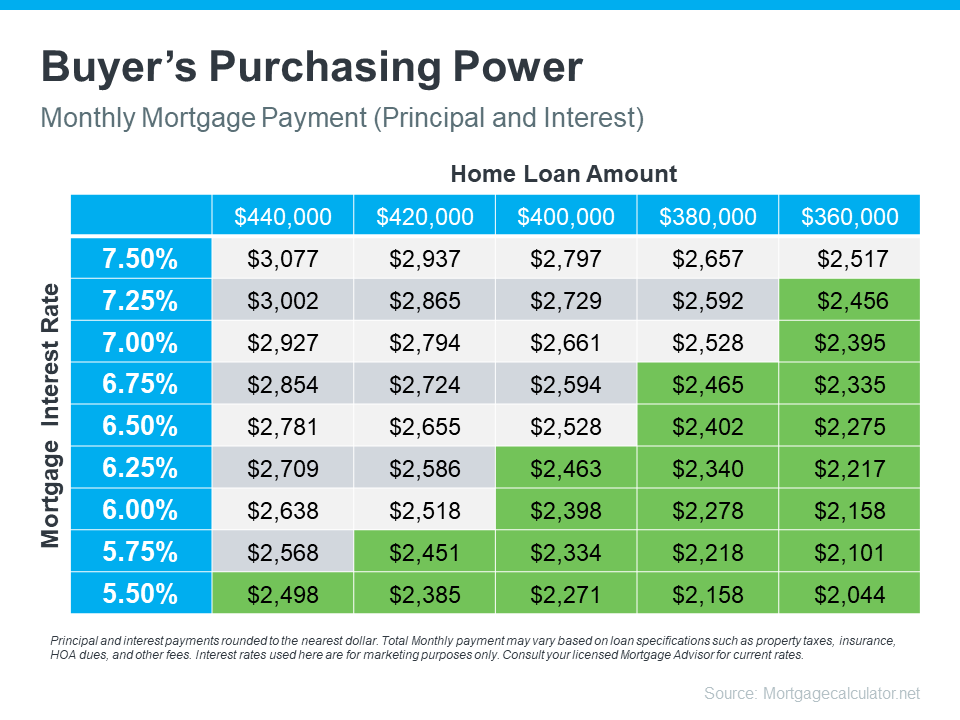

Understanding the connection between mortgage charges and your month-to-month house fee is essential to your plans to become a homeowner. The chart under illustrates how your capacity to afford a house adjustments when mortgage charges shift. Think about your funds permits for a month-to-month fee between $2,400 and $2,500. The inexperienced half within the chart reveals funds in that vary or decrease (see chart under):

As you may see, even small adjustments in charges can have an effect on your funds and the mortgage quantity you may afford.

Get Assist from Dependable Consultants To Perceive Your Price range and Plan Forward

Whenever you’re trying to buy a home, it is vital to get steerage from a neighborhood actual property agent and a trusted lender. They may also help you discover totally different mortgage choices, perceive what makes mortgage charges go up or down, and the way these adjustments impression you.

By wanting on the numbers and the newest knowledge collectively, then adjusting your technique primarily based on at this time’s charges, you may be higher ready and able to purchase a house.

Backside Line

In case you’re trying to buy a home, it is best to know the latest downward pattern in mortgage charges is nice information to your transfer. Let’s connect and plan your subsequent steps.