Is Wall Road Shopping for Up All of the Properties in America?

In case you’re eager about buying a home, chances are you’ll end up within the newest real estate headlines so you may have a pulse on all the issues that would influence your resolution. If that’s the case, you’ve most likely heard point out of traders, and questioned how they’re impacting the housing market proper now. That would go away you asking your self questions like:

- What number of properties do traders personal?

- Are institutional traders, like massive Wall Road Companies, actually shopping for up so many properties that the typical individual can’t discover one?

To reply these questions, right here’s the actual story of what’s occurring primarily based on the info.

Let’s begin with establishing what number of single-family properties (SFHs) there are and what portion of these are leases owned by traders. In line with SFR Investor, which research the single-family rental market in the USA, there are eighty-two million single-family properties on this nation. However what number of of them are literally leases?

In line with data shared in a current publish, sixty-eight million (82.93%) of these properties are owner-occupied – that means the one who owns the house lives in it. In case you subtract that sixty-eight million from the full variety of single-family properties (82 million), that leaves nearly fourteen million properties left which might be single-family leases (SFRs).

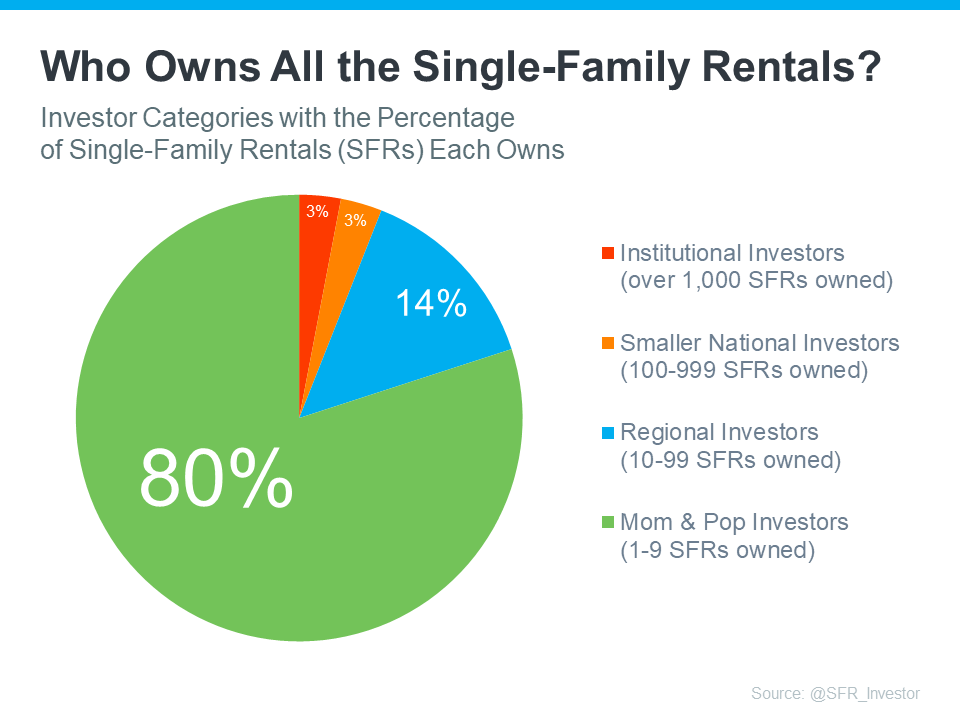

Do institutional traders personal all of these remaining fourteen million properties? Not even shut. Let’s take it one step additional. There are 4 classes of traders:

- The mother & pop investor who owns between 1-9 SFRs

- The regional investor who owns between 10-99 SFRs

- Smaller nationwide investor who owns between 100-999 SFRs

- The institutional investor who owns over 1,000 SFRs

These classes present that not all traders are massive institutional traders. To assist convey that much more clearly, listed below are the odds of rental properties owned by every sort of investor (see chart beneath):

As you may see within the chart, regardless of what the information and social media would have you ever consider, the inexperienced exhibits the overwhelming majority should not owned by massive institutional traders. As a substitute, most are owned by small mother & pop traders, like your pals and neighbors.

What’s really occurring is, that there are individuals on the market, similar to you, who consider in homeownership, and so they view shopping for a house (or a second dwelling) as an funding. Perhaps they noticed a possibility to purchase a second dwelling over the previous few years to make use of it as a rental and generate extra revenue. Or possibly they only determined to maintain their first home reasonably than promote it after they moved up.

So, don’t consider all the things you learn or hear about institutional traders. They aren’t shopping for up all of the properties and making it unimaginable for the typical individual to purchase. That’s simply not what the numbers present. Institutional traders are literally the smallest piece of the pie chart.

Backside Line

Whereas it’s true that institutional traders are a participant within the single-family rental market, they’re not shopping for up all the homes available on the market. In case you have different questions on belongings you’re listening to in regards to the housing market, let’s join so you will have an professional to provide the context you want.