Down Cost Help Applications Can Assist Pave the Strategy to Homeownership

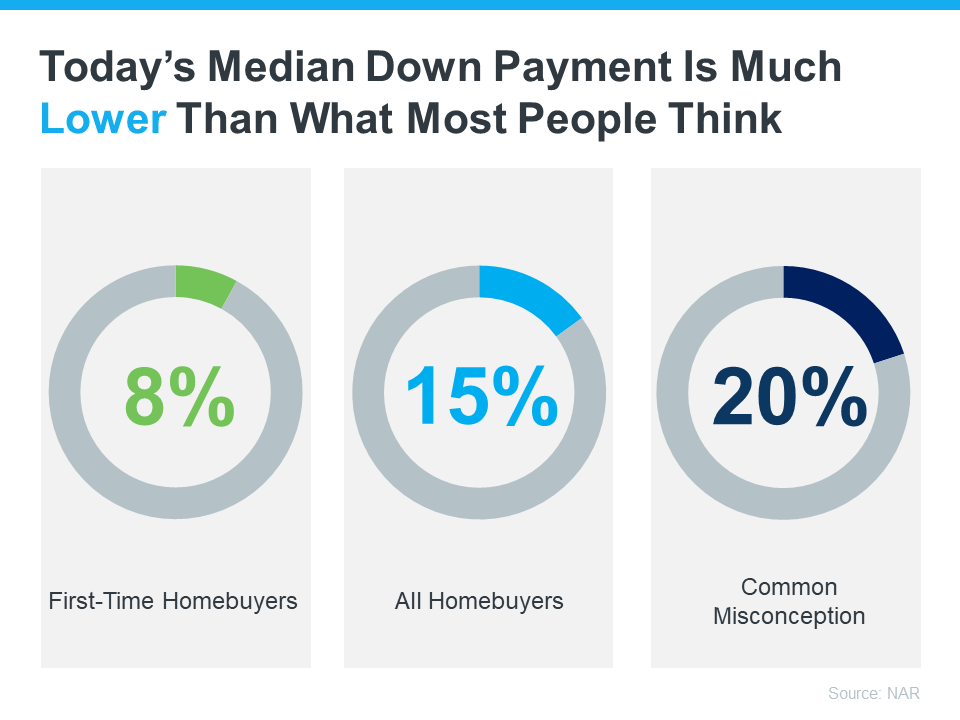

When you’re trying to purchase a house, your down cost doesn’t should be an enormous hurdle. According to the Nationwide Affiliation of Realtors (NAR), 38% of first-time homebuyers discover saving for a down cost probably the most difficult step. However the actuality is, you in all probability don’t must put down as a lot as you suppose:

Knowledge from NAR shows the median down cost hasn’t been over 20% since 2005. Actually, the median down cost for all homebuyers in the present day is barely 15%. And it’s even decrease for first-time homebuyers at 8%. However simply because that’s the median, it doesn’t imply you need to put that a lot down. Some certified patrons put down even much less.

For instance, there are mortgage varieties, like FHA loans, with down funds as little as 3.5%, in addition to choices like VA loans and USDA loans with no down cost necessities for certified candidates. However let’s focus in on one other precious useful resource that could possibly assist together with your down cost: down cost help packages.

First-Time and Repeat Patrons Are Usually Eligible

In accordance with Down Payment Resource, there are literally thousands of packages obtainable for homebuyers – and 75% of those are down cost help packages.

And it’s not simply first-time homebuyers which might be eligible. Meaning irrespective of the place you might be in your homebuying journey, there may very well be an possibility obtainable for you. As Down Cost Useful resource notes:

“You don’t should be a first-time purchaser. Over 39% of all [homeownership] packages are for repeat homebuyers who’ve owned a house within the final 3 years.”

The perfect place to start out as you seek for extra info is with a trusted actual property skilled. They’ll be capable of share extra details about what could also be obtainable, together with extra packages for particular professions or communities.

Extra Down Cost Sources That Can Assist

Listed below are a number of down cost help packages which might be serving to lots of in the present day’s patrons obtain the dream of homeownership:

- Teacher Next Door is designed to assist lecturers, first responders, well being suppliers, authorities staff, active-duty army personnel, and veterans attain their down cost objectives.

- Fannie Mae gives down-payment help to eligible first-time homebuyers residing in majority-Latino communities.

- Freddie Mac additionally has choices designed particularly for homebuyers with modest credit score scores and restricted funds for a down cost.

- The 3By30 program lays out actionable methods so as to add 3 million new Black householders by 2030. These packages supply precious sources for potential patrons, making it simpler for them to safe down funds and notice their dream of homeownership.

- For Native Individuals, Down Payment Resource highlights 42 U.S. homebuyer help packages throughout 14 states that ease the trail to homeownership by offering assist with down funds and different related prices.

Even in case you don’t qualify for a majority of these packages, there are lots of different federal, state, and native choices obtainable to look into. And an actual property skilled may also help you discover those that meet your wants as you discover what’s obtainable.

Backside Line

Reaching the dream of getting a house could also be extra inside attain than you suppose, particularly when the place to seek out the precise assist. To be taught extra about your choices, let’s join.