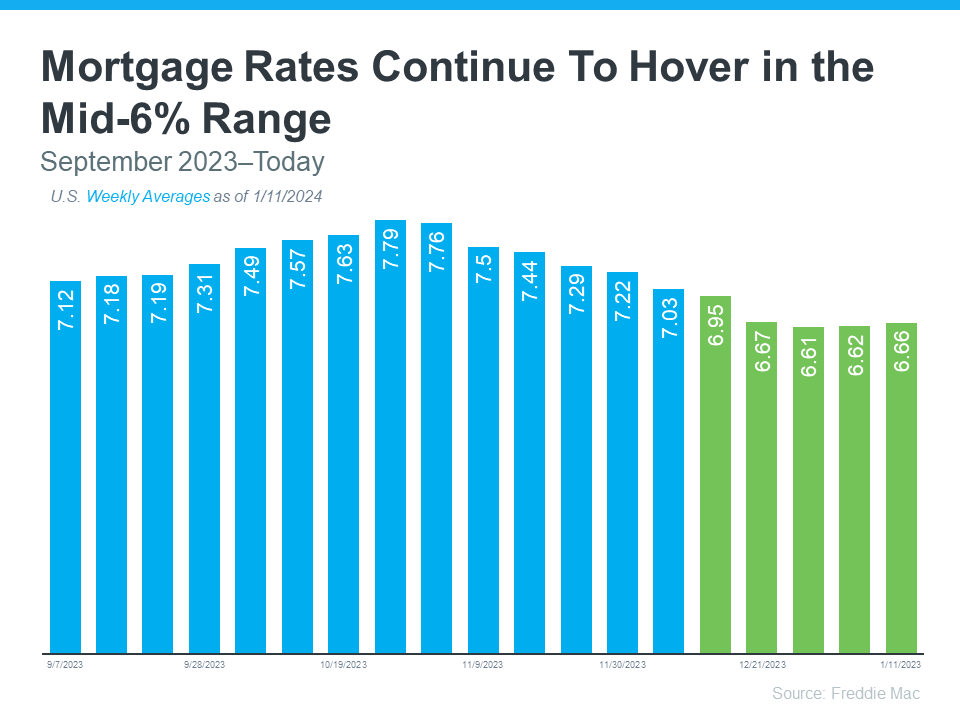

When you’ve been holding off on promoting your own home to make a move since you felt mortgage charges had been too excessive, their current downward development is thrilling information for you. Mortgage charges have descended since final October after they hit 7.79%. In truth, they’ve been below 7% for over a month now (see graph beneath):

And whereas they’re not going again to the three% we noticed throughout the ‘unicorn’ years, they’re anticipated to proceed to go down from the place they’re now within the close to future. As Dean Baker, Senior Economist on the Heart for Financial Analysis, explains:

“It additionally seems that mortgage charges at the moment are falling once more. They’ll virtually definitely not fall to pandemic lows, though we could quickly see charges underneath 6.0 p.c, which might be low by pre-Nice Recession requirements.”

Listed here are two the reason why this current development, and the expectation it’ll proceed, is such good news for you.

You Could Not Really feel as Locked-In to Your Present Mortgage Price

With mortgage charges already considerably decrease than they had been just some months in the past, you might really feel much less locked-in to the present mortgage fee you may have on your own home. When mortgage charges had been increased, moving to a brand new house meant probably buying and selling in a low fee for one up close to 8%.

Nevertheless, with charges dropping, the distinction between your present mortgage fee and the brand new fee you’d be taking over isn’t as huge because it was. That makes moving extra inexpensive than it was just some months in the past. As Lance Lambert, Founding father of ResiClub, explains:

“We may be at peak “lock-in impact.” Some move-up or way of life sellers may be coming to phrases with the very fact 3% and 4% mortgage charges aren’t returning anytime quickly.”

Extra Consumers Will Be Coming to the Market

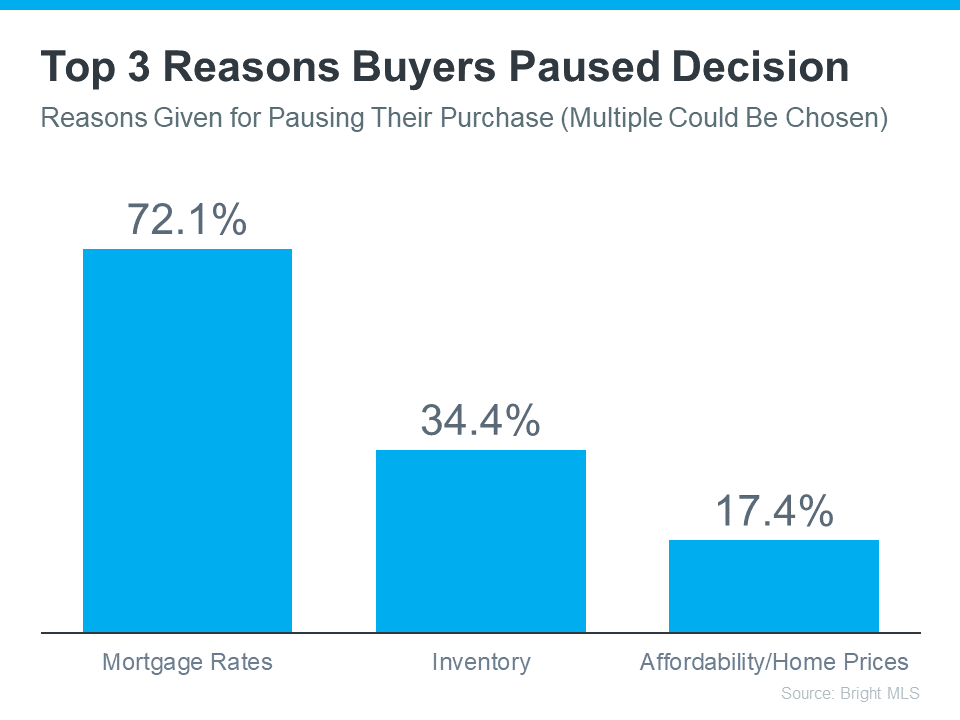

In line with data from Shiny MLS, the highest motive consumers have been ready to make the leap into homeownership is excessive mortgage charges (see graph beneath):

Decrease mortgage charges imply consumers can doubtlessly get monetary savings on their house loans, making the prospect of buying a house extra enticing and inexpensive. Now that charges are easing, extra consumers are prone to really feel they’re prepared to leap again into the market and make their transfer. And extra consumers imply extra demand for your own home.

Backside Line

When you’ve been ready to promote since you didn’t wish to tackle a bigger mortgage fee otherwise you thought consumers weren’t on the market, the current decline in mortgage charges could also be your signal it’s time to maneuver. If you’re prepared, let’s join.