Should you’re holding out hope that the housing market goes to crash and produce home prices again down, right here’s a have a look at what the info exhibits. And spoiler alert: that’s not within the playing cards. As an alternative, specialists say home prices are going to maintain going up.

At this time’s market could be very completely different than it was earlier than the housing crash in 2008. Right here’s why.

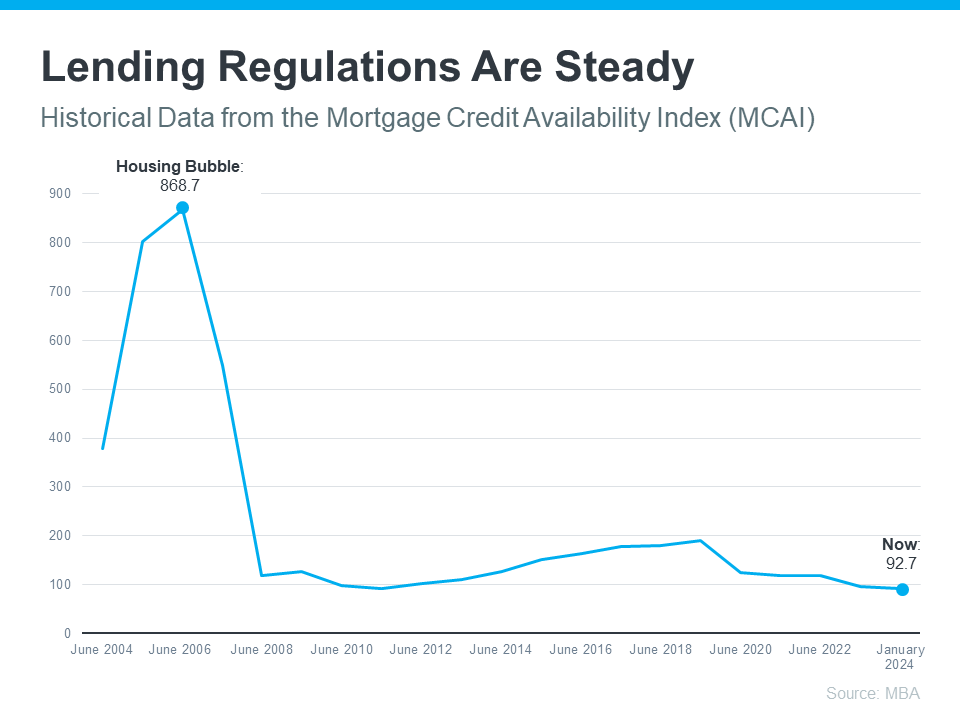

It’s More durable To Get a Mortgage Now – and That’s Really a Good Factor

It was a lot simpler to get a house mortgage throughout the lead-up to the 2008 housing disaster than it’s at the moment. Again then, banks had completely different lending requirements, making it straightforward for nearly anybody to qualify for a house mortgage or refinance an present one.

Issues are completely different at the moment. Homebuyers face more and more increased requirements from mortgage firms. The graph under makes use of data from the Mortgage Bankers Affiliation (MBA) to point out this distinction. The decrease the quantity, the more durable it’s to get a mortgage. The upper the quantity, the better it’s:

The height within the graph exhibits that, again then, lending requirements weren’t as strict as they’re now. Which means lending establishments took on a lot higher threat in each the individual and the mortgage merchandise provided across the crash. That led to mass defaults and a flood of foreclosures coming onto the market.

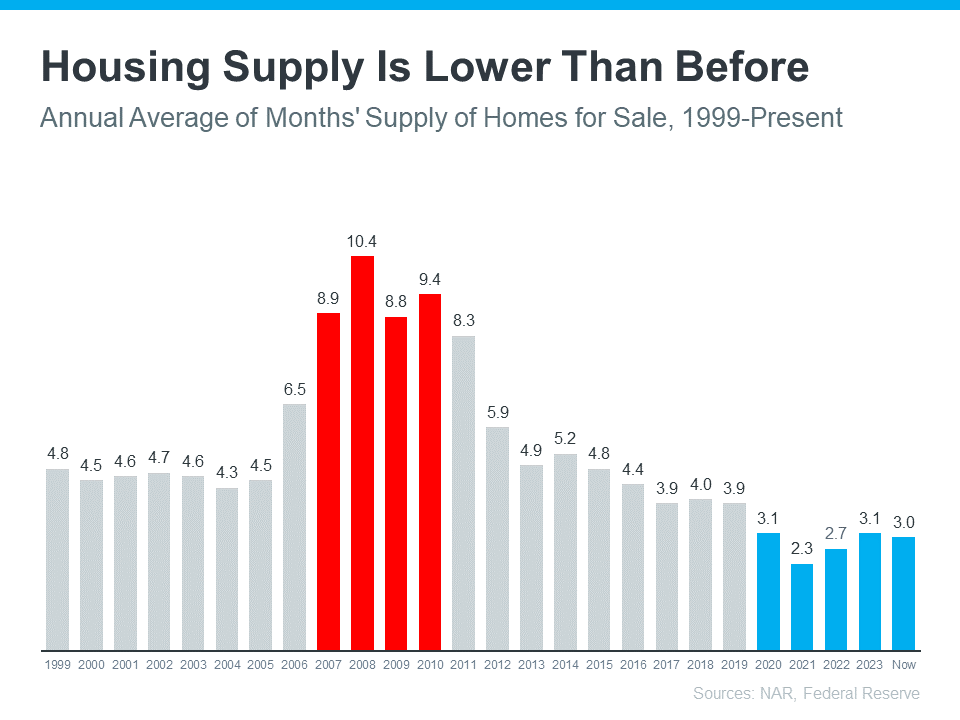

There Are Far Fewer Houses for Sale At this time, so Costs Received’t Crash

As a result of there have been too many properties on the market throughout the housing disaster (a lot of which have been quick gross sales and foreclosures), that precipitated dwelling costs to fall dramatically. However at the moment, there’s a list scarcity – not a surplus.

The graph under makes use of knowledge from the National Association of Realtors (NAR) and the Federal Reserve to point out how the months’ provide of properties obtainable now (proven in blue) compares to the crash (proven in crimson):

At this time, unsold stock sits at only a 3.0-months’ provide. That’s in comparison with the height of 10.4 month’s provide again in 2008. Which means there’s nowhere close to sufficient stock available on the market for dwelling costs to come back crashing down like they did again then.

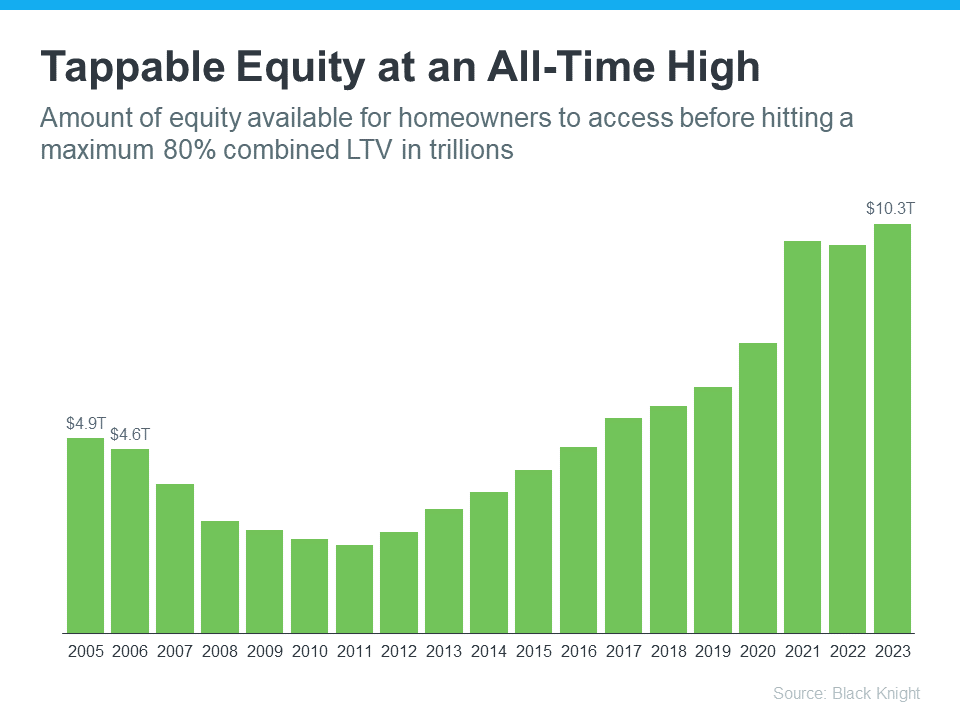

Folks Are Not Utilizing Their Houses as ATMs Like They Did within the Early 2000s

Again within the lead as much as the housing crash, many owners have been borrowing towards the fairness of their properties to finance new vehicles, boats, and holidays. So, when costs began to fall, as stock rose too excessive, a lot of these owners discovered themselves underwater.

However at the moment, owners are much more cautious. Regardless that costs have skyrocketed prior to now few years, owners aren’t tapping into their fairness the best way they did again then.

Black Knight reports that tappable fairness (the quantity of fairness obtainable for owners to entry earlier than hitting a most 80% loan-to-value ratio, or LTV) has really reached an all-time excessive:

Which means, as an entire, owners have extra fairness obtainable than ever earlier than. And that’s nice. Owners are in a a lot stronger place at the moment than within the early 2000s. That very same report from Black Knight goes on to explain:

“Just one.1% of mortgage holders (582K) ended the 12 months underwater, down from 1.5% (807K) presently final 12 months.”

And since owners are on extra strong footing at the moment, they’ll have choices to keep away from foreclosures. That limits the variety of distressed properties coming onto the market. And with no flood of stock, costs gained’t come tumbling down.

Backside Line

When you could also be hoping for one thing that brings costs down, that’s not what the info tells us goes to occur. Probably the most present analysis clearly exhibits that at the moment’s market is nothing prefer it was final time.