There’s been quite a lot of recession speak over the previous couple of years. And that will depart you anxious we’re headed for a repeat of what we noticed again in 2008. Right here’s a take a look at the most recent professional projections to point out you why that isn’t going to occur.

According to Jacob Channel, Senior Economist at LendingTree, the economic system’s fairly robust:

“A minimum of proper now, the basics of the economic system, regardless of some hiccups, are doing fairly good. Whereas issues are removed from good, the economic system might be doing higher than folks wish to give it credit score for.”

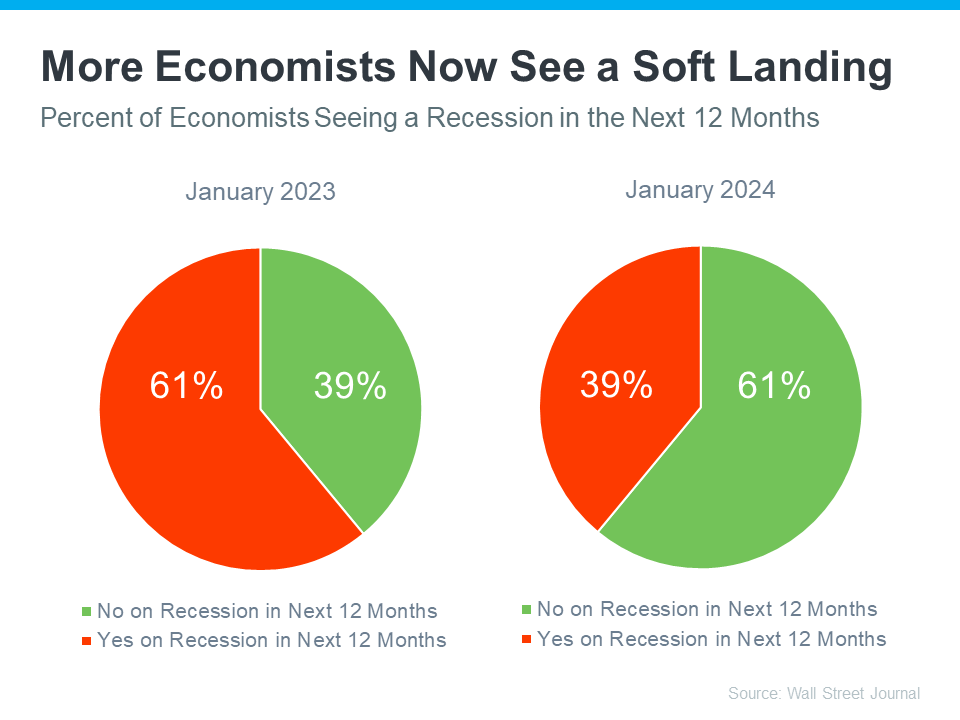

That is likely to be why a recent survey from the Wall Road Journal reveals solely 39% of economists assume there’ll be a recession within the subsequent 12 months. That’s approach down from 61% projecting a recession only one 12 months in the past (see graph under):

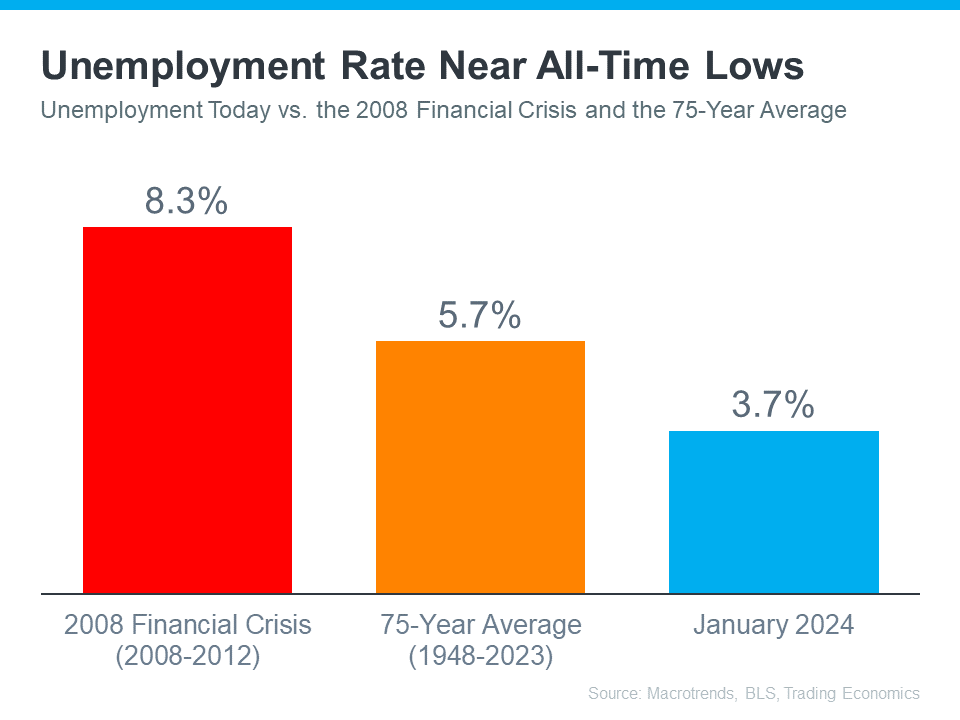

Most consultants consider there gained’t be a recession within the subsequent 12 months. One cause why is the present unemployment charge. Let’s evaluate the place we are actually with historic information from Macrotrends, the Bureau of Labor Statistics (BLS), and Trading Economics. After we do, it’s clear the unemployment charge immediately remains to be very low (see graph under):

The orange bar reveals the typical unemployment charge since 1948 is about 5.7%. The pink bar reveals that proper after the monetary disaster in 2008, when the housing market crashed, the unemployment charge was as much as 8.3%. Each of these numbers are a lot bigger than the unemployment charge this January (proven in blue).

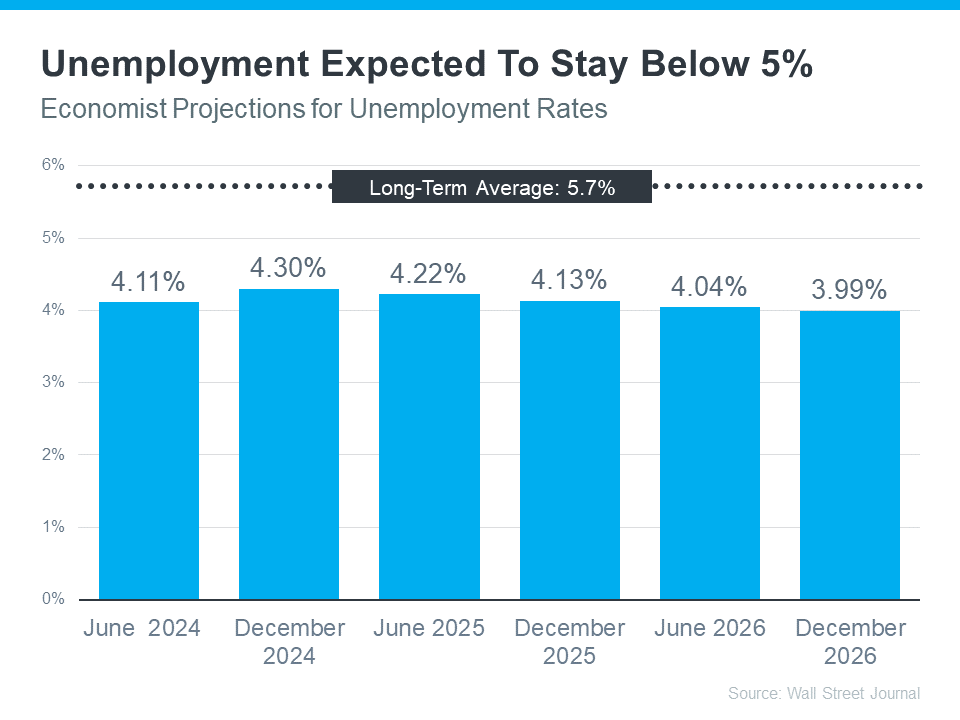

However will the unemployment charge go up? To reply that, take a look at the graph under. It makes use of information from that very same Wall Road Journal survey to point out what the consultants are projecting for unemployment over the subsequent three years in comparison with the long-term common (see graph under):

As you’ll be able to see, economists don’t anticipate the unemployment charge to even come near the long-term common over the subsequent three years – a lot much less the 8.3% we noticed when the market final crashed.

Nonetheless, if these projections are appropriate, there might be individuals who lose their jobs subsequent 12 months. Anytime somebody’s out of labor, that’s a tricky state of affairs, not only for the person, but additionally for his or her buddies and family members. However the huge query is: will sufficient folks lose their jobs to create a flood of foreclosures that might crash the housing market?

Trying forward, projections present the unemployment charge will doubtless keep under the 75-year common. Which means you should not anticipate a wave of foreclosures that might affect the housing market in a giant approach.

Backside Line

Most consultants now assume we cannot have a recession within the subsequent 12 months. Additionally they do not anticipate a giant leap within the unemployment charge. Which means you don’t have to concern a flood of foreclosures that might trigger the housing market to crash.